Students planning to attend should complete the Free Application for Federal Student Aid (FAFSA) for the current academic year. Apply online at https://studentaid.gov/h/apply-for-aid/fafsa. SUSCC School Code is 001040. Please make sure that you monitor your College email and your myellucian experience account regularly for updates. Students who have not applied for admission must apply before the financial aid office may begin processing the FAFSA application.

Instructions for your College Email can be found at: https://www.suscc.edu/email

| If you plan to attend college from: |

You will submit this FAFSA: |

Using income and tax information from: |

| August 2025 - July 2026 | 2025-2026 | 2023 |

| August 2026 - July 2027 | 2026-2027 | 2024 |

INFORMATION YOU WILL NEED WHEN COMPLETING YOUR FAFSA:

- Federal School Code is 001040

- Federal tax returns from prior prior year

- Driver’s license number

- Asset information (real-estate other than your home, businesses, farms, investments…)

- Federal processor 1-800-4-FED-AID (1-800-433-3243)

All students applying for the federal financial aid programs must submit a FAFSA (www.studentaid.gov). Students applying on the web would first apply for a FSA User ID and Password in order to sign the FAFSA online. Parents of dependent students also need a FSA User ID and Password. Students will be notified by school email of eligibility.

Federal Pell Grant

The Pell Grant is an entitlement program, which means all students who qualify will be awarded the grant. This grant is intended for “exceptionally needy” students, as defined by federal guidelines and determined by completing the FAFSA. Each student completing the FAFSA is assigned an “SAI number", an eligibility index number that your college’s or career school’s financial aid office uses to determine how much federal student aid you would receive if you attended the school. Pell Grant award ranges are based on Congressional appropriations. Award amounts will also vary based on student enrollment status. Students are not required to be full-time during Fall and Spring, but the amount of the grant is prorated for less than full-time enrollment. Summer enrollment is optional. If the student desires to take courses during summer semester, no additional application is required.

Each semester Southern Union sets priority deadlines to ensure processing is completed before classes begin. The deadlines are as follows:

Fall Semester: June 1st

Spring Semester: November 1st

Summer Semester: April 1st

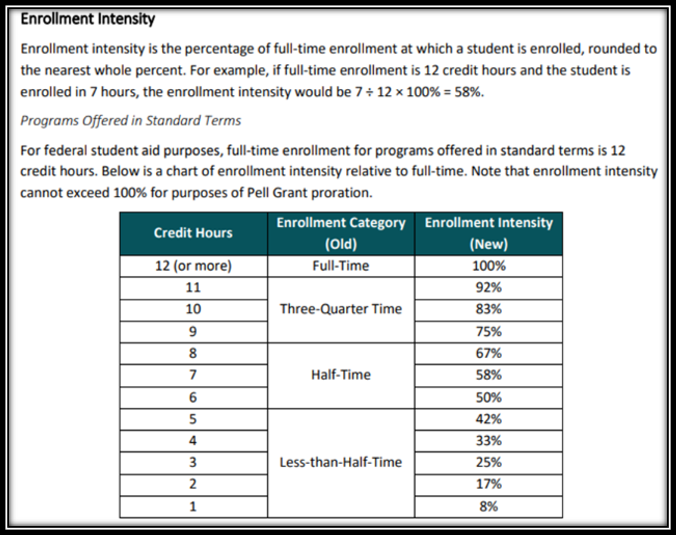

Enrollment Intensity Chart

Students should register for all courses at the start of the semester to ensure all registered courses are included in their award disbursements. This includes full term, mini terms, five-week courses. Disbursement amounts and the timeframe of release will depend on the number of credit hours for each individual term.

Federal Supplemental Educational Opportunity Grant

The SEOG is a grant program for the neediest students (those who qualify for the Pell Grant). Funds are very limited, so those students who complete the FAFSA by June 1 will receive priority consideration. Awards are generally $1,000 per academic year. Must be enrolled in at least six credit hours and meet Standards of Academic Progress. Students will be notified by school email if determined eligible.

Loan Application Process

- Students will accept the offer on their MySUSCC student portal.

- Complete Entrance Counseling and sign a Master Promissory Note (MPN) at www.studentaid.gov.

- Balances due to the student will be disbursed by check. Students must keep address current with Admissions to avoid any delays in receiving your loan disbursement.

Balances due to the student will be disbursed by direct deposit or paper check via postal mail.

When all required information is received and processed, students will receive an award notification from the Financial Aid Office. Direct Student Loan awards are initially made with the assumption of full-time enrollment each term. Your cost of attendance will be adjusted prior to disbursement each term when you enroll less than full-time. This downward adjustment in cost may require that the aid previously awarded may need to be reduced to comply with federal regulations.

Students can access and monitor all of their federal loan information, as well as loan servicer contact information, by visiting the National Student Loan Data System (NSLDS) website at www.nslds.ed.gov.

Direct Student Loans

- Subsidized loans are awarded on the basis of financial need. Interest is deferred prior to repayment beginning and during authorized periods of deferment.

- Unsubsidized loans are not awarded on the basis of need. Interest is charged from the date the loan is disbursed until the loan is repaid.

First-time borrowers awarded the Direct subsidized loan on or after July 1, 2013 are subject to the 150% Direct Subsidized Loan Limit (SULA), which limits the amount of time a student is eligible to borrow subsidized loans to 150% of their published program length.

Students must begin repayment of student loans once they graduate or cease enrollment of at least 6 credit hours within a semester. Students may be granted a six-month grace period before repayment is effective. Exit counseling is required once the student ceases enrollment at the institution. This process may be completed online at studentaid.gov. Additional information about service providers and repayment can be found at nslds.gov.

Direct PLUS Loans

PLUS loans enable parents with good credit histories to borrow funds for educational expenses for each dependent child. PLUS loan applications may be completed through www.studentaid.gov. PLUS borrowers must also complete the Credit Check and sign a Master Promissory Note (MPN) using your FSA User ID and password at www.studentaid.gov.

Loan Limits

- Freshmen can receive up to $3500 in subsidized loans per academic year, or $1750 per semester.

- Sophomores can receive up to $4500 in subsidized loans per academic year, or $2250 per semester. (Students must have earned 32 hours to be considered a sophomore)

- Dependent students may qualify for an additional $2000 in unsubsidized loans per academic year, or $1000 per semester.

- Independent students may qualify for an additional $6000 in unsubsidized loans per academic year, or $3000 per semester.

**Loan amounts are subject to change based on SULA limits and Cost of Attendance**

.png)

Loan Default Rates:

The U.S. Department of Education (the Department) publishes cohort default rates based on the percentage of a school’s borrowers who enter repayment on Direct Loan Program loans during a federal fiscal year (October 1–September 30) and default before the end of the second following fiscal year.

SUSCC prides itself in maintaining low default rates by utilizing Inceptia Default Management Plan. Through this partnership, SUSCC regularly communicates with currently and/or previously enrolled students about payment options and various topics relating to their student loans.

To view SUSCC default rates, visit the link below and enter OPEID 001040.

https://nsldsfap.ed.gov/cdr-searchable-database/school/search